TAKE CONTROL OF YOUR FINANCIAL HEALTH NOW!

We constantly hear today all the issues regarding Healthcare.

How we need to take care of ourselves and YET who is looking out for our "Financial Health"

these days in Washington? Do politicians have a vested interest in our financial health

anymore?

As nation, for decades following the Great Depression the lesson was we should "save". Can

we really call ourselves a "saving" nation in 2021?

How we need to take care of ourselves and YET who is looking out for our "Financial Health"

these days in Washington? Do politicians have a vested interest in our financial health

anymore?

As nation, for decades following the Great Depression the lesson was we should "save". Can

we really call ourselves a "saving" nation in 2021?

NOW we spend and spend on credit and the political elites encourage this behavior along

with the financial institutions that contribute to them year after year. Healthcare has certainly

been a central political issue for over two decades now and we still have no real solutions

while no one ever seems to address the declining FINANCIAL HEALTH of our citizenry

and our nation as a whole. Why is that? Who has a vested interest is seeing consumers

pay more for borrowing? Why even after banks and lending institutions were bailed out

over a decade ago has little to nothing changed with how banking and lending services

are conducted?

over a decade ago has little to nothing changed with how banking and lending services

are conducted?

How is it that has our economy expands and leads the world our borrowing interest rates continue to rise for average consumers in America. It is stated that some 220 million Americans have Fair or Below Average credit using the FICO scoring modeling. 220 million out of roughly 360 million Americans. While our government continues to borrow on the back of our national debt and borrowing from the Chinese , there appears little support or will in Congress to address spending and borrowing. They have treated our debt no different than consumers revolving credit accounts and see it merely as a federal charge card for a bill later generations will certainly have to pay.

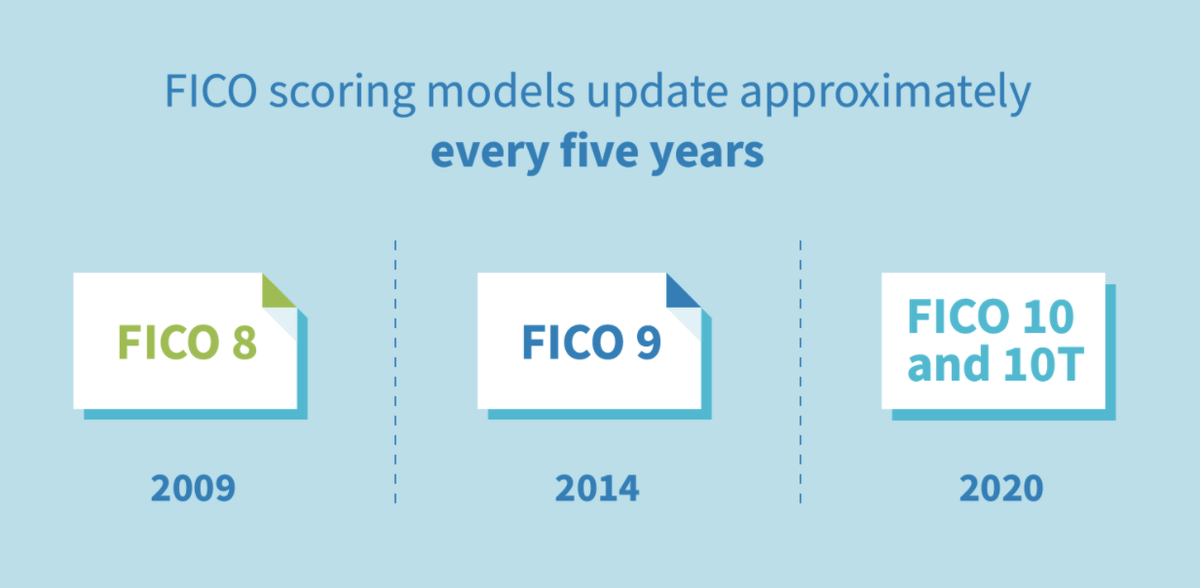

Consumers however, do not have that luxury. In fact, consumers are about to get crushed under a new credit scoring model that is being rolled out to banking and lending institutions that is the most anti-consumer of any of the prior scoring models. This model is known as FICO 10t. FICO is the number one method to evaluate applicants for consumer credit followed VantageScore. Currently the predominate model used is FICO 8, however this will likely be replaced by years end as banks switch over to FICO10t.

Fair Issac Corporation (FICO) is a public company that has been around since the 1950's and has had a virtual monopoly over consumer credit scoring. FICO (NYSE: FICO) "powers decisions that help people and businesses around the world prosper. Founded in 1956 and based in Silicon Valley, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 180 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, telecommunications, health care, retail and many other industries".

FICO is trading today at five year highs on the NYSE. In fact, FICO is trading roughly the same market value as Apple Computer. This is most likely do to pre-booked sales of the FICO 10 & 10t modeling across its client platforms. This is a huge indicator that FICO 10 modeling will become the norm in 2021.

In short, FICO partners and work with the lenders not borrowers. Borrowers are not FICO's customer base. Banks and financial institutions are and FICO seeks to provide the financial industry with the means of providing the reason why interest or borrowing rates are so widely different for varying consumers. The industry claims these rates are a direct relationship to the "risk" they are assuming yet the "risk" is defined in truth by the scoring model used. For example, a consumer credit score often is completely different from all three of the national credit bureaus.

FICO 10t will punish the average consumer. FICO 10t unlike FICO 8 or 9 uses a "trailing" twenty four month scoring model as opposed to the "snapshot" of the current modeling where it simply uses your current three digit score "in the moment". FICO10t instead permits lenders to look back two years into the borrowing and payment behavior of consumers. The immediate effect will be if a consumers score under FICO 8 is under 620-30 the FICO 10t modeling will lower the score even further. The reason for this is the change in the scoring parameters and the weighted measures that FICO places in areas of the credit profile.

Revolving credit accounts were once king. Revolving accounts are typical credit cards. However, under FICO 10t "revolving" accounts are considered more negatively than ever before replaced with a higher value upon "installment" loans. Why the change? The change it appears obvious is set to benefit lenders.

For example, revolving accounts permit consumers to increase utilization up to the credit limit. Thus a consumer could qualify today for a loan under FICO 8 with low utilization (balance to limit ratio) "in the moment" and than after closing on a loan can then potentially utilize the entire credit limits on revolving accounts thus potentially creating a situation where the borrower may at some point be unable to pay back loan payments. FICO 10t permits lenders to review two years of consumer habits so if a consumer historically tuns high utilization yet "in the moment" its utilization is low the history will carry more weight in the scoring than the current ratio of balances to limits.

While Washington is focused on Covid-19 and Second Stimulus Checks debates, little is being done to address how consumers will be negatively impacted by FICO 10t which will ultimately costs borrowers more.

"Built on predictive analytics created from huge data stores of consumer behavior, FICO® Scoring Solutions distill data down to a score, as a concise measurement of risk. FICO® Scoring Solutions are easily understood and provide automated decision-making capability that can be integrated into a company’s operations as the basis for taking action.

Sophisticated mathematical and statistical processes exploit patterns found in traditional and new sources of data to better identify risks and opportunities, and capture relationships across many factors to drive better results"

The driver of these results is to the benefit of lenders not borrowers. Consumers have accepted these scoring models largely with no push back in large part due to the fact that Washington is so in bed with the financial sector that little has ever gotten done in addressing these scoring models.

Consumers are left to themselves to navigate the credit industry. We are never taught credit in schools let alone taught credit by our families. Individuals are left to navigate their "financial health" alone for the most part and accept the "three digit code" that identifies them. In truth, consumers are nothing more than a number and this number determines everything with regard to one's ability to borrow or and some cases even qualify for a job.

Many have likely seen the marketing push recently by Experian Boost. This marketing push is a direct result of the reality that Experian already understands that FICO 10t is going to hurt consumer credit scores. The boost in effect is a mean of raising an individual credit score artificially outside the FICO scoring model in truth undertaken by the credit bureau. The question remains how effective the boost will be longer term. This is why bureaus are beginning to add other credit entries such as gas, utilities, rent and most recently subscription services.

No in truth has prepared consumers for FICO 10t. There has been largely no conversations in Washington regarding the matter. Other matters have consumed the Congress and FICO 10 has rolled out in almost stealth-like fashion.

Lenders are under no obligation to use the FICO 10 modeling though they are certainly paying for it so in all likelihood most utilize the scoring model though they still can run the FICO 8 or 9 modeling at least in the interim.

What can consumers do today?

The first thing to do is to begin to take one's "financial health" seriously as much as one would take the actual health. Examine the impact of FICO 10 in the context of your current credit and spending habits. Develop an action plan or if you require one based on how to mitigate FICO 10 we have a no cost guide available based on consultation with a leading financial institution to help guide consumers through this new paradigm of credit scoring. Readers of The Conservative State can receive this information simply by requesting it be emailed to them from theconservativestate2020@gmail.com.

Readers will get an Action Plan and suggestions to address high debt ratios or how to address one's credit profile to prepare for FICO 10. This may include removing items from one's credit file or adding additional lines that raise one's score that are not included in the current profile but will be beneficial under FICO 10 & 10t.

The time is now. Consumers cannot wait until FICO 10t is formally accepted by all financial institutions likely by January 2021 to take action. It will be too late. Remember FICO 10t uses a trailing modeling so what consumers do in the next six months will impact their scores dramatically.

Consumers have already been impacted with unemployment and other Covid-19 related issues negatively and though tax payers may be provided an additional stimulus benefit the question consumers have to ask themselves is how best to use that stimulus. Spend it on a whim or use it to address their "financial health" and the impending new scoring model from FICO.

Take action today. You future ability to borrow very well may depend on it.

No comments:

Post a Comment